It is true that many individuals have had truly negative experiences with Online Gambling, and I’m not referring to delayed pays or slow pays where eventually the players received their money, but rather to sites that have no-paid the players as well as sites that have used either rigged or rogue software. As a result, there are any number of casinos that have been Blacklisted between LCB.org and Wizardofodds.com

One key difference between Online Casinos and something known as, ‘Binary Options,’ however, is that Online Casinos are, more often than not, reputable and pay in a reasonably timely way whereas Binary Options are essentially just straight up fraud. In fact, there are many comparisons that can be drawn between Binary Option fraud and some of the shadier things that have been done in the industry of telemarketing over the years, and as this story weaves on, I will attempt to draw some parallels between the two while relating my personal experiences in the latter.

The first thing that should be understood about these Binary Options is that they prey on the weak with a promise of quick returns. Furthermore, they also prey on the financially weak as well as the mentally weak who cannot see the scam for what it is. In fact, socio-economically disadvantaged people are a prime target of the BInary Options industry because they will be inclined to go for anything as long as it sounds like it could be profitable. People buy into these Binary Options for the same reason as some disadvantaged people play the lottery, the hope of a return that is both significant and quick. The primary difference with the lottery, of course, is that one might actually win...and a 60ish percent return on the State Lottery is downright generous compared to what people can expect from Binary Options.

What the Hell is a Binary Option?

Apologies for the term for hades, but really, isn’t that going to be the question on the minds of most people reading this? Many people are at least passingly familiar with how the stock market and trading stocks works, and perhaps people even have a familiarity with commodities markets, but Binary Options are not something that every investor will be familiar with because, in order to be successful in Binary Trading, one actually has to have a more in-depth knowledge of how short-term fluctuations work than most people are going to have. In order to be profitable on the Binary Markets, it actually takes an intense amount of research to have the requisite knowledge to, ‘Pick one’s spots,’ in order to jump in.

What we will do for the time being is compare Binary Options to the Stock Market insofar as the two things can actually be compared, so that we can look at the differences between the two. If you don’t know how the Stock Market works in even the most rudimentary way, (you try to buy stock in a company for a lower price than you sell it) then these comparisons might not be particularly helpful, but you can find general information on how the stock market works in any number of online sources, so I would suggest Googling that...but only if you know literally NOTHING about how stocks work. If you know anything at all about how stocks work, then your knowledge will be sufficient to understand the comparisons to Binary Options.

1.) How does the actual trading work?

With the stock market, there are limitations to how much you can lose (how much did you pay for a particular stock) but there are effectively no limitations for how much you may enjoy in theoretical gains...just ask the people who bought Google way early in the game or the people (like me, yay!) who got SiriusXM stock for less than $0.10/share at one time. In fact, that happens to be the only really serious stock play I’ve ever made in my life, but I was THAT sure about it.

Another thing about the Stock Market is the fact that, unless the company goes belly up and the stock becomes completely delisted or valueless, you can essentially sell your stock anytime you want, or alternatively, you may continue to own the stock into perpetuity; it’s really up to the stockholder what he or she would like to do.

With respect to the differences with Binary Options as compared to the preceding two paragraphs on stocks, there are tremendous differences. The way Binary Options work in the United States (and most other places) is that you will pay a certain amount for an, ‘Option,’ and it is actually an Option to either hold your position or to sell at a later time. In fact, for those of you familiar with Political Betting Markets and those Options, Binary Options are actually not much different in principle, except, they usually have a tendency to be an even shorter-term play, and therefore, will resolve more quickly.

Let’s not get ahead of ourselves, though. We’re going to use a real-world example, here. As of this day and time (6/22/16 at 22:03EST) WTI Crude Oil is currently going for $49.13/barrel. An example of a theoretical Binary Option would give me the ability to buy the position that WTI Crude Oil is going to finish above $50.00/barrel at 23:00EST on 6/24/16. When this Option is resolved, in other words, when WTI Crude Oil either finishes above $50.00 on the prescribed date and time or finishes under that, the Option is either closed out at $0.00 or $100.00. If you bought the Option, if oil finishes above that price, then you have made $100 on that option less whatever amount you bought the Option for. If oil finishes below that price, and you did not sell your option before the conclusion, then you will get $0.00 and will have lost all of the money invested.

One might ask: Well, who am I buying and selling these options from? In the United States, the answer to that is simple: Other Binary Option investors, or bettors, or gamblers...however you want to look at it. When you look into the process of dealing with a particular proposition (much like traditional forms of gambling) you’re going to be presented with a, ‘Bid,’ and an, ‘Offer,’ which might be compared to betting Black or Red at a Roulette Table.

What a, ‘Bid,’ would be is that an individual is willing to pay that particular amount for a Binary Option on the premise that the individual either believes:

A.) That the Proposition in question will finish on the, ‘Yes,’ side, going back to our example, that would mean that the WTI price would finish above $50.00 at the specified date and time.

OR:

B.) The person may not necessarily believe that the oil will finish at that price, but he believes that other people believe that it will strongly enough that the, ‘Bid,’ side of the Binary Option will go up enough that he can present an, ‘Offer,’ that people will take by which he will make more money than he paid for the, ‘Yes,’ side of that Option. In other words, let’s say that he bought the Option 36 hours before the Proposition becomes finalized, he may have essentially bought that thinking that other investors would later think that it is a good option.

B.) (Continued) For example, Oil Prices tend to fluctuate a certain degree each way on a daily basis, so this Binary Option trader may believe that there will be a time that his Proposition looks far more likely to land on the, ‘Yes,’ side of the equation than it does at the present moment, although, he is not altogether confident that the result will be a, ‘Yes.’ What he is essentially hoping for is that the Option will look attractive enough at a later time to be worth more to someone else than what he initially paid for it. In fact, if it seems like an unlikely Proposition, then there is a good chance that it will trade for less than $50.00, so he may decide to, ‘Bid,’ or accept an, ‘Offer,’ of $40 in the hopes that the WTI looks, at some point, like it is making a strong run and he can sell for more than that later.

In order to make another comparison to Political Betting Options, it is all but an absolutely sure thing that Donald Trump will be named the Republican Nominee for President at the Republican Convention in Cleveland. However, even though Trump has the majority of the delegates (by more than was expected, for that matter) Donald Trump winning the Nomination is not technically a sure thing. Therefore, a Political Option on Donald Trump is currently ‘trading’ for anywhere from 1.12-1.18 Odds on Betfair, even though that system is more straight betting and works a little differently. Even though it is all but a sure thing that Trump will be the nominee, a person could either back (for Americans, read: Take) 1.15 Odds that Trump will be the nominee meaning one could risk $100 to win $15 if he does, or one could Lay Odds of 1.16 meaning one could risk $16 in order to win $100 if he does not. As you can see, if you made both bets, then you would either win $15 and get your hundred back (but lose $16) if he did, or you would lose $100 if he did not, but also, ‘Win’ $100 and get your $16 back thereby resulting in an overall win of $0.

Let me break that down more simply with a little table:

| Bet (Proposition) Trump Wins | Bet (Proposition) Trump Loses | To Win (Trump Wins) | To Win (Trump Loses) | Lose | Overall Result (Success) | Overall Result (Failure) |

|---|---|---|---|---|---|---|

| $100 | - | $15 | $100 | +$15 | -$100 | |

| - | $16 | - | $100 | $16 | +$100 | -$16 |

| +$115 | -$116 |

As you can see, by betting both ways, the overall result is going to be that, if Trump does win, the bettor will lose $1 because he will, ‘Win,’ $15 on the Proposition that Trumps is the winner (and gets his $100 back on that) but loses $16 on the Proposition that Trump does not win.

If it happens the other way and Trump loses, then the bettor will lose his $100 on the Proposition that Trump was going to win, however, the bettor will, ‘Win,’ $100 on the Proposition that Trump was going to lose and the bettor shall also get his original $16 back. Therefore, the result of that for the bettor is a profit/loss of $0.00.

In essence, by playing both sides of this bet in this way, the bettor could only lose.

However, if the bettor had an opportunity to, on one hand, bet $100 to win $17 on Trump to win as opposed to $16 to win $100 on Trump to lose, then our table would look like this:

| Bet (Proposition) Trump Wins | Bet (Proposition) Trump Loses | To Win (Trump Wins) | To Win (Trump Loses) | Lose | Overall Result (Success) | Overall Result (Failure) |

|---|---|---|---|---|---|---|

| $100 | - | $17 | $100 | +$17 | -$100 | |

| - | $16 | - | $100 | $16 | +$100 | -$16 |

| +$117 | -$116 |

What we see here is that the situation has reversed itself exactly because the Player, now acting as the House would normally wish to act, is, ‘Playing the middle,’ which is also known as an arbitrage. In other words, the player will either win nothing, or in the event that Trump wins the nomination, the player will be profitable because the bettor is betting $16 on Trump losing (which is lost if Trump wins) to win $100 but is betting $100 on Trump to win in order to win $17 if he does. In other words, the result is either zero-sum or $1.00 for the wagerer.

The concept of arbitrage rarely presents itself in the world of Binary Options because there would have to be a vast disparity between the two possible outcomes (and where one is buying them both) in order to be assured a profit carrying through one or the other until the Proposition is resolved. However, the concept of middling is one that does present itself, to a certain degree.

Essentially, the Binary Option bettor wants to successfully make a, ‘Bid,’ on the Option that he will eventually be able to sell later at a higher price, or alternatively, the Binary Option player believes that he has sufficient equity on the Bid coming to fruition in order to justify riding it out until the end.

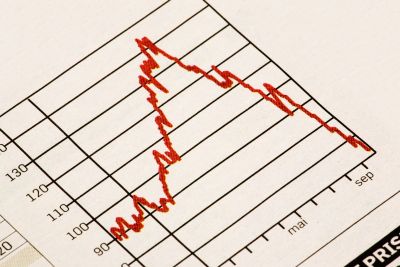

The fluctuations in value of Binary Options, prior to the point of actual resolution, are based on the likelihood the investors believe that the option will result in a, ‘Yes.’ It is for this reason that, the closer that the Resolution of the Proposition becomes and the more likely it is looking to go one way or another, the Option will rapidly increase or decrease in value. Getting back to our oil example, if someone bought an option at $40.00 but, ten hours before the time of the Resolution, WTI oil is going for $47.80, (nowhere near the $50 target and significantly below where it was trading at the time the option was purchased) then it is extremely likely that the Option itself will be, ‘Bid,’ for far less than the $40.00 that it was once purchased for. In fact, the option that says, ‘Yes, oil will be $50.00 or more on that date and time,’ may well be nearly valueless.

Contrastly, if at the same time, the WTI is trading at $52.25, then it would appear extremely likely that it is going to finish above $50.00 at that particular date and time. As a result, there will likely be Bids well in excess of the $40.00 for which the option was purchased 36 hours prior, in fact, the Option may well be trading near the $100 mark, which is what the Option will, ‘Close out,’ at upon Resolution if the ultimate result is a, ‘Yes.’

With respect to the actual trading, then, individual people are actually trading these options with one another, however, there are sharks in the water both in the form of people who do this professionally or semi-professionally, or actual companies who put a high degree of research and statistical analysis into determining the best plays and making mass quantity Bids or Offers on Binary Options.

The price of a Binary Option is simply whatever the market agrees that the price is. It is for this reason that the, ‘Bids,’ which simply mean how much an individual is willing to purchase a certain option for, will fluctuate as well as the, ‘Offers,’ which simply mean how much an individual is willing to sell a certain option for. With respect to these, the actual price that is agreed upon (within a short time period) will usually be somewhere between the Highest Bid and the Lowest Offer at any particular time a person is looking. In order to complete a transaction with someone, then the person looking to get involved will almost invariably need to be Bidding more than the highest Bidder at that time, or to make an Offer for less than whatever is the lowest Offer at that given time. If it seems like this process is similar to, ‘Haggling,’ in a traditional sales environment, that’s because it is pretty much what it is.

At the same time, however, an individual might decide to, ‘Hedge,’ in order to compare this to more traditional forms of gambling. By, ‘Hedging,’ I mean the person might decide to sell his Proposition (Option) before the Resolution is determined. There are many reasons that a person may do this, if an Option is trading at a much higher amount than it was purchased, or even if it only slightly higher but the person is not as confident in the outcome as he once was, then he may make an, ‘Offer,’ on his option in order to, ‘Lock in a profit,’ by selling his OPtion for more than he bought it. Alternatively, an individual might decide to sell his Option for less than he bought if for because he thinks that the, ‘No,’ side of the Proposition is looking extremely likely and he wishes to, ‘Cut his losses.’

2.) Maximum Gain, Loss and Range

Imagine that you are making a, ‘Bid,’ on the, ‘Yes,’ side of a Binary Option and your Bid is accepted. At this point, there are really only three things that can happen:

In the event that the Proposition is Resolved and the Resolution was a, ‘Yes,’ then the Option becomes worth $100 and the person shall profit $100 less whatever he paid for the Option less whatever the fees were. If it cost $0.50 to make the transaction and the transaction was made for $50 and finishes on the, ‘Yes,’ then the individual will have profited $49.50. This $49.50 also represents the Maximum Theoretical Gain on this Option because, even if the individual could sell the Option for $100 (this would never happen, as a practical matter) then the individual would have to pay the Transaction Fee (again) and would, therefore, actually be making less than the $49.50.

In terms of Maximum Loss, for someone who is making a Bid, then the Maximum Loss is whatever the amount the Bid was made for plus any associated fees with the transaction in the event that the person retains the Option until Resolution and that Resolution ends up being a, ‘No.’ In other words, with the example in the first paragraph, the most the individual could stand to lose is $50.50. Technically, an individual could theoretically lose more than that by selling the Option for less than $0.50 and having to pay another $0.50 Transaction Fee, but I’m going to go ahead and assume that nobody's that stupid.

The Range, then, is always going to be the $100. The difference between the Maximum Theoretical Loss and the Maximum Theoretical Gain (even if one includes the fees) on any given transaction is going to be $100.

These concepts are what make Binary Options attractive for many people, unlike stocks, which are usually bought in multiples of 100 and generally cost more than $1.00 each (at least, for major companies) the Theoretical Range is essentially boundless, even though the maximum amount that could be lost on any one transaction is fixed, but the fact remains that people are playing with much bigger dollar amounts on a single move and that may make some people uncomfortable. Binary Options are different because that Theoretical Range is always going to be $100 with the amount to theoretically be gained or lost on a single Option falling somewhere under $100 both ways.

In many ways, however, Binary Options tend to be similar to other forms of gambling in that the, ‘Longer-shots,’ tend to come at a greater, ‘House Edge,’ (even though it is really an advantage to the person on the other side of the transaction in Binary Options) than do the likely results. The reason for this is pretty simple, really, people love to make long-shot bets.

This is a characteristic that is seen in virtually every form of gambling if you think about it. If you look at people that like to purchase Lottery Tickets, then what you see are a bunch of people who (looking at something like Mega Millions or Powerball) are perfectly content to pay $1 or $2 for the possibility of winning tens or hundreds of millions of dollars with an extremely likely scenario of losing the entire bet and at a tremendous House Edge. If people invested everything they had on one Mega Millions drawing, for example, then the most likely result is that they would end up having much less to invest (if anything) after the drawing.

If you take a look at the Proposition Betting page for Sports on the Wizard of Odds site, then you will notice that there are many situations, particularly with respect to Super Bowl Propositions, that the individual who is, ‘Laying,’ money can find himself at a real-world advantage, and that’s even in a scenario where the House is supposed to have an edge that works against BOTH sides of the bet! Once again, this is because people generally have the tendency to perceive an unlikely event as being more likely than it statistically is combined with the fact that higher payouts for a lesser amount bet are fundamentally attractive to most people.

We also see this represented in the House Edges of many Table Games with respect to Side Bets (and other types of bets, such as on the Craps Table) in which the bets that have a larger potential payout also have a greater House Edge against the person making the bet. By definition, these bets pertain to outcomes that are far less likely to occur than the Even Money Propositions.

3.) The Offer

Many of you might be wondering where the, ‘Offer,’ side of the Binary Option comes in. The offer simply means that the person is risking the opposite of what the Bidder is because the person making The Offer is hoping for the opposite outcome.

For example, if a bidder purchases a Binary Option at $52.00 hoping for the, ‘Yes,’ side to come in, then the person who made the Offer at $52.00 is hoping for the, ‘No,’ side to come in and will lose $48.00 (plus the cost of the transaction) if that side does not come in. As you can see, much with the Maximum Theoretical Range (always $100) of what the person who buys the, ‘Yes,’ side of the option can get, the spread between what the person who takes the, ‘Yes,’ can profit and the person who makes the, ‘Offer,’ selling while hoping for the, ‘No,’ can lose will also equal $100.

It’s basically the same thing, just reversed. This is somewhat comparable to how a Sports Book might put out an Opening Line, and if there is equal betting on both sides of that Line, (and it is not an even number line, such as -3) then there is absolutely no way that the Sports Book can fail to profit due to the vig that they are taking on one side of that line or another, and occasionally, both. (Think -105 on both sides of a 50/50 Proposition) If $1050 in total action came in on both sides of a 3.5 Line at -105, for example, then regardless of the result, the winners would get $1,000 (total) as well as their $1,050 bets back and the losers would lose $1,050, and as a result, the Sports Book would be $50 in the good. There would be $2,100 in total action, and one way or another, the Sports Book only pays $2050 of that back out. The Vig would be 2.38% in that case of all monies bet.

4.) A Zero-Sum Game

When it comes to the actual process of trading Binary Options itself, generally speaking, there is no Vig in the strictest sense of the term. The spread between what each side stands to win or lose will always be $100 and the total amount that both sides stand to lose (theoretically) will always total $100 while the total amount that both sides stand to win will total, I bet you can guess: also $100!

If there was a platform upon which Binary Options could be traded completely for free, then strictly speaking, there would be no House Edge, but much like a Poker Game, the effective edge either for a particular individual or against him would fluctuate.

Imagine a home poker game for which no vig is taken, at the end of the night, the exact amount of money that comes to the Table also leaves the Table. However, with respect to each of seven (we’ll say) individual players who each brought $100 (for example) with them, are they each expected to leave with exactly $100? The answer to that one is: Absolutely freaking not!!! The best poker player is expected to leave with the most money, and while that will not necessarily happen every single night the poker game takes place, in the long run, if someone is consistently and remains the best player at the table, then he should win the most money. IN the long run, again, the worst player at the table should ultimately lose the most money...so we see that the edge fluctuates from player-to-player in that regard, at least, in terms of what I like to call the, ‘Effective House/Player Edge.’

The process of Binary Option Trading is precisely not at all different. Some people will have the requisite knowledge and experience necessary to make better choices than their counterparts. As a result, the people who are simply better at it will make more money (or, at least, lose money less quickly) than those who are not particularly adept at playing the binary Markets. In fact, some of these Binary Options Players are incredibly sophisticated often dealing in detailed statistical analyses which are then converted into simulators and computer programs that are often quite reliable in finding the best Propositions for a particular individual to take. These people will then use these Propositions to make as many purchases as possible within a specified, ‘Target Range.’

That process is also quite comparable to Sports Betting in the sense that there have been a few statisticians who have whipped up computer programs to tell them the best bets who then use, ‘Runners,’ or other means, to get as much money down as possible on the side that they like. If a particular individual decides, by one means or another, that he likes a particular side of a particular Proposition, then he will want to get as much on that side as he is able and willing to risk to as feasible degree as possible.

Imagine if a Sports Book was not situated such to have a House Edge built into the Line, in other words, imagine if a Sports Book would accept wagers and conduct the payouts, but both sides of a particular line first had to agree, individually or severally, how much they would be putting on each side of the Line and those amounts had to be equal for a generally closer to Even Money type Proposition (such as Over/Unders or Point Spreads) or they had to balance out according to the Odds being bet upon exactly. (Such as Moneylines or Prop Bets) In the event that there was such a Book, you might ask, how would they make any money?

The answer to that is simple and reflects how the Binary Option Brokers make their money, they simply charge a fee. For example, each Nadex contract costs $0.90 to enter and $0.90 to exit. In other words, every time one of these Options is moved (with one exception) Nadex makes $1.80. The lone exception to this is when an Option is Resolved, any fees for the Exit will be assessed to those on the, ‘Yes,’ side of that particular Option while there are no fees charged for exiting to those on the, ‘No,’ side.

In that sense, then, in order to Bid a particular Option in order to later Offer it at a greater price in order to make a profit, the Option would actually have to be (on Nadex) offered (and accepted) at an amount of $1.80 or more than what it was purchased for in order for the person offering it to be able to profit.

Imagine a fictitious Market in which a particular Option could only be Bid and Offered on one occasion and then, after the transaction is completed, it is, ‘Frozen,’ until resolution. What would happen there is that the two sides would pay a combined $1.80 in order to enter into the contract to begin with, and then, the side that finishes, ‘In the money,’ will also pay an additional $0.90 for the Exit Fee at the time of Resolution. In other words, a total of $100 will be effectively wagered between the two parties for which the MINIMUM fees that the Nadex broker will collect is $2.70. That comes to 2.63% of the total money changing hands being straight-up fees. That is the House Edge and the House absolutely cannot lose because the game is Player-Banked. This is very similar to taking a Vig in Poker, but at least Poker Vigs are taken relative to the Pot size.

Actually, there is one exception with Nadex contracts in terms of the fees, and that is that they are capped at $9 on a given Proposition, so an individual or entity purchasing more than ten lots on a given Proposition does not pay any fees for any lots in excess of the tenth one. Again, this aspect of it also tends to favor the skilled investors who, as would be expected, are going to be far more likely to buy multitudinous amounts of lots on a given Proposition.

5.) How straight up is it?

To be quite honest, in the United States anyway, the trading of Binary Options is actually a fairly, ‘Straight up,’ procedure. Each side picks the side that it likes, determines what it is willing to pay for the contract, (whether it be the Bid side or Offer side) and understands how much there is to be gained or loss as well as how much will be paid in fees, depending on the outcome and whether or not a position is resold.

In the words of legendary Poker Professional and Commentator Mike Sexton, Texas Hold ‘Em takes, ‘A minute to learn and a lifetime to master,’ and the same can be said of Binary Options as well as any other form of Stock Trading, really. The only way to overcome the fees associated with Entering Into and Exiting Contracts is to know what you are doing to such an extent that you are not only significantly better than your peers, but ideally, you would not jump around on the same Proposition so many times as to be repaying the fees more than is absolutely necessary or otherwise advantageous.

To put it bluntly, if you’re exceptionally good at it and have an innate understanding of many factors such as short-term consumer confidence (in the Propositions going up or down on the Bid/Offer end) as well as the Statistical Analysis required to recognize and capitalize on a fundamentally positive Proposition, then you have a chance to make some money with Binary Options. To put it even more frankly, if you suck, then you will lose money other than some Variance in the short-run that will enable the occasional poor trader to make profits in the short-term and build up and undeserved confidence that, much like those who play systems such as the Martingale on a negative expectation gambling game, will eventually lead to their downfall.

Of course, this is all assuming an otherwise level playing field with the only downfalls for a particular individual being disparity in skill and the fees, but what happens when the playing field is less level than that which can be enjoyed in the United States?

The Game is Sometimes Rigged Abroad

Everything that we have discussed in the previous section with respect to Binary Options made a few necessary assumptions that are true in the case of United States Exchanges. To wit, the Binary Option itself is fundamentally a zero-sum game with the only exchange of monies taking place between the person making the Bid and the person making the Offer when those two sides agree on a price, and what the Exchange makes is the Entry or Exit fee associated with a particular option. In other words, other than this fee which is Universal and directly-stated, the, ‘House,’ as it were, does not take a cut.

What would happen if there were an actual House in the sense that it was a closer thing to Sports Betting who not only took a cut of the action (by way of having a spread between positions and being able to, ‘Play the Middle,’ but also charged fees on top of that? In order to answer that question, we look at Binary Options Trading outside of the United States.

Overseas, this is actually the exact case because the Options are typically offered by individual brokers or companies rather than an actual Regulated exchange for the Options. As a result, the Brokers can actually make the spread between the Bid and the Offer so great that they simply collect whatever is in the middle, all the while, the investors who are familiar with how Binary Options would usually work are under the mistaken assumption that they are playing the usual game. In fact, many of them are specifically misrepresented to believe exactly that.

Furthermore, these particular Binary Options are a one-time play to a certain degree in many cases. What that means is that the entity purchasing the Option is going to end up holding it until the Option is resolved with no opportunity to, ‘Cut their Losses,’ or, ‘Lock in a win.’ Of course, many people will recognize that as the sheer opposite of exactly what zero-sum trading is supposed to entail and how Binary Options are actually supposed to work. That being said, there are some Binary Options overseas that work in the manner such that they can be Offered at a later time to someone else, it’s just that many of them do not work that way.

When this happens, you either make $100 less the investment or you lose the investment, it’s that simple, really. The individual broker is only going to allow for offers such that he cannot lose to the extent that the Offer is a significantly higher price than the Bid, every single time.

If you wanted to compare it to Sports Betting, think of it like a Money Line type bet, because that is probably the most accurate comparison. In the case of these Options, however, the disparity in the Line is often insurmountably severe.

You might ask, well, what if nobody likes the numbers on one side or the other? That is an excellent question that will be explored later on, and in fact, is where things start to get extremely shady. For now, we’ll just say there is a reason that most of these brokers are not allowed to solicit residents of the United States…

There are also other types of Binary Options that tend to be more, ‘Exotic,’ than those offered in the United States that are available overseas. One example is an Option in which there is a certain price, ‘Goal,’ for a particular thing and the Option is considered a winner (depending on what side the person is on) if it succeeds in hitting a particular price point at any time during the event. If we go back to the oil example from earlier, in the event that the target price of $50.00 was hit anytime in that 48 hours, regardless of where it finishes, then the Resolution would be a, ‘Yes.’ These sorts of Options can also be purchased on the Proposition that a particular exchange or commodity will hit a certain low point, at least once, during the timeframe in question.

There is another type of option that is essentially the exact opposite of that detailed above, and it is known as a, ‘Range,’ option. The way that a Range Option works is that there will be a certain price Range (minimum to maximum) and the Option in question must stay within that set range for the entire duration of the event, rather than finishing within that range at the end. In the event that the price moves outside of that range either way, then the Resolution is a, ‘No,’ and the amount that was invested is lost.

This would obviously lead one to ask: In what ways can the game be rigged with these types of trades?

1.) As we have briefly touched upon, when you look at what we might otherwise call, ‘Traditional,’ Binary Options under these new conditions, what happens is that the individual broker is setting both the Bid and the Offer. As a result, in a situation that is ideal (for the broker) what will happen is that the broker will simply make the difference between the two in profits regardless of what actually happens. The, ‘Edge,’ that the two individual investors are bucking is essentially half of the difference between the Bid and the Offer.

While it is true that, due to this spread, there may still be some advantageous situations to be had, the game is fundamentally rigged and these advantageous situations will be fewer and farther between. There still might be some good Bids or Offers out there to pounce on, but generally speaking, the middle is set such so that, even if one side has an advantage on an option, the disadvantage is that much greater for the other side.

Again, some people might suggest that there might not be a person who wants to take the Bid or Offer at a particular level, but in that event, the broker could simply adjust for that, or alternatively, the person in question might be having his or her Options managed by an external entity who knowingly takes bad positions on the investor’s behalf because they are getting a, ‘Commission,’ which is to say a piece of that middle ground. That is actually one of the shadiest possible scenarios that can play out in this regard, and we’ll go more in-depth on that later.

2.) When we look at the, ‘High Point,’ or, ‘Low Point,’ type options within a certain parameter, these options are offered within parameters that are actually set by the broker. The reason that this can become relevant and extremely detrimental to the investor is that the broker is going to have a good handle on the statistics associated with a particular option, and therefore, can rig the game so that his probability of winning (combined with what must be paid out if he loses) is going to be more than enough to offset the risk he is taking. Once again, that is even if he is taking a risk at all.

Much with the Traditional Binary Options, this particular type of Contract enables the broker to set high points and low points that are so far opposite one another that the broker is likely to win on one side or the other, if not both. There will certainly be occasions where, if only two Contracts were purchased (one high and one low) that the short-term fluctuation will be wild enough for the broker to lose on both ends, but this will usually not be the case. In fact, the broker is far more likely to win on both ends of the spectrum than lose, and that is because the broker decides what the high points and the low points are.

These types of Options also have the potential for a Fixed Loss as well as a Fixed Win if the, ‘Yes,’ side of the Proposition comes in. Because the amount being Invested and the amount to be one are fixed, they are similar to Traditional Options in that regard. One area where the two may differ significantly is that, with the High and Low Points, an investor may select an Option that will win less than the amount invested because it is either more likely than not to happen, or the investor, at least, is meant to perceive the event as being more likely than not.

On the other hand, these, ‘Range,’ type options also lend themselves to the ability that it is unlikely that a particular Option will resolve in a, ‘Yes,’ by either touching the High Point or the Low Point that would result in such a Resolution. In these cases, the Investor might stand to gain far more than the amount being invested, especially in the case of extreme long-shots. Again, much like the House in the casino, the broker is going to offset the potential for large payouts by ensuring that his probability of winning (relative to the amount that he will lose on a Yes) as compared to the amount invested is at such a discrepancy that the investor is bucking a tremendous House Edge. This might be akin to a single number bet at a Roulette Table, but then, Roulette has a fixed House Edge on a single number bet depending on how many zeroes there are on the wheel...the broker might essentially be offering a single number bet on a wheel with fourteen zeroes in addition to the thirty-six other numbers!

3.) The concept of a Range Option is much similar with regards to the relationship between the Broker and the Investor. The Range itself can be set such that, with varying degrees of likelihood, the event in question will stay within the price Range for the duration.

In these cases, Investors, once again, can choose between more likely Propositions as well as extreme long-shots. For example, if oil was at $49.08/barrel and an Investor wanted to take an option that it would stay between $49.07-$49.09 for 48 hours, then that Option would offer a potentially huge return due to the extreme unlikelihood of staying within that Range. In fact, it is somewhat unlikely that it will stay within that range for ten minutes of trading time, much less two days.

Alternatively, a Range bet can theoretically be one in which it is more likely than not to stay within that range. THe individual broker is going to compensate for this, obviously, by offering a much lower payout relative to the amount invested.

Why Are the Overseas Markets Attractive to Some?

The reason that the overseas Binary Options are attractive to some people is the same as why they are attractive to people in the United States, to wit, they have a Maximum Theoretical Loss which is simply whatever the amount is that the Contract is purchased for. In other words, these types of Options, in all circumstances, theoretically give people the opportunity to have full control over their investments with respect to the, ‘Risk,’ side of the equation.

Furthermore, unlike Binary Options in the United States, some overseas Binary Options also do give the ability for a person to theoretically enjoy extremely large payouts if a long-shot comes in. While this is different than buying a lottery ticket in the sense that a $1 wager is not going to result in winning hundreds of millions of dollars, (not even theoretically) it is similar in the sense that it appeals to the, ‘Get rich quick,’ aspect of the psyches of some people.

Finally, overseas Options simply offer a wider range of choices with respect to having different types of Contracts as compared to the United States Binary Options. This gives people the ability to perhaps fall into the mistaken belief that they play the Traditional Contracts well, or that they play the Ranges or High/Low Contracts well. In all likelihood, they do not play any of them well and are bucking a greater disadvantage than Trading Binary Options in the United States against people who are more talented investors (and this includes any fees that have to be paid) but, again, they believe that they can win in the end...however, as with any negative expectation game, the chance of finishing ahead diminishes the further into the long-run one gets.

Why Do Investors Keep Investing?

Some might wonder why the investors would keep investing in the face of the tremendous losses that they often incur. One reason is that the assumed probability of a particular outcome may be perceived as more likely than it actually is.

For example, let’s take a look at those High/Low Contracts. If an Investor loses money on a particular play, then the first thing that the Investor is likely to do is take a look at the fluctuation in the Range of the event in question. In other words, the Investor is going to pay attention to, ‘How close he got.’ A good friend of mine has a saying when it comes to NFL Wagering, particularly one he uses in admonishing poor bettors, “The game always starts tied at 0-0.”

What that phrase means, in this context, is that markets fluctuate on a basis on minutes, let alone hours or days. The result of that is going to be an extreme likelihood that, within a particular range of time, the event in question is going to be higher than it started but not high enough that the Proposition results in a, ‘Yes.’ In other words, an Investor is going to see that, yes, the event in question did go up at some point...but that doesn’t mean that, from a statistical standpoint, it was even remotely likely that the event would go up (or down) enough. It is this tendency that will result in Confirmation Bias, to a certain extent, that the Investor actually made a particularly adept play, but just got unlucky when, actually, the opposite is true: He would have had to get lucky in order to WIN!

Once again, that is because the broker is offering the Bids and Offers based on a thorough statistical examination of what is or is not likely to happen. Not only does the broker realize that the fluctuations will be such that the event in question, at some point, is much more likely to be higher than it started...the broker is absolutely counting on it!

Chew on this: If an individual is an Investor and he notices that every single time he bets a, ‘High Point,’ type Investment that the event in question does nothing but trend down and never even touches the point at which he bet on it, then that Investor is going to lose Confidence in a real hurry and realize he sucks at what he is trying to do. On the other hand, an investor who frequently perceives himself as, ‘Getting close,’ to the target in question is going to actually gain a measure of confidence despite the fact that he lost, and is more likely to try again.

This is also the same with the relationship between the Investor and the, ‘Range,’ Options. In the case of the, ‘Range,’ options, the broker is betting heavily on the fact that the event in question is going to go outside of that range within a given time period one way or the other, if not both. In the meantime, the Investor is hoping that the event stays inside of that Range. What is interesting about this dynamic is that the broker will have certainly made the Offer pursuant to his understanding that, based on the amounts to be won or lost, he has the best of it given the likelihood of the particular event eventually wandering outside of that Range.

This is relevant because, if a given event does wander outside of a particular Range, chances are it is not going to do it by a number that the Investor considers extreme in terms of getting killed. For example, if the Range on oil is $48.80-$49.70 within a period of a week and it ends up at $49.82 on the High side causing the investor to lose, the Investor may well determine, ‘Well, that didn’t go over by that much, it looks like I bet a pretty good range there.’

The problem is that the Investor is dead wrong. It’s kind of like betting a single number on the Roulette wheel, or perhaps a section of numbers (on the wheel) and having the result land just outside of that section: It doesn’t matter how, ‘Close,’ you were, you still lost.

The ultimate result of all of these Exotic Options is going to be that the Investor perceives himself as having been, ‘Close,’ in one way or another as opposed to having gotten absolutely destroyed. It really is better for people starting to get into this thing to get destroyed early on and have their confidence shattered...better a bruised ego than a battered wallet. (Which also bruises the ego, sometimes irrevocably).

The bottom line is this: The Investor CANNOT win, or in those rare events in which the Investor can win (other than someone who is extremely serious) those events are too few and far between to be worth the Investor’s time.

It Works the Same as Gambling, Because It Is Gambling

Much like in the act of gambling, and this is particularly comparable to Sports Wagering, the reward centers of the brain are going to get all lit up and excited when an Option ends profitably for the Investor while those losing occasions tend to be forgotten or disregarded. Much like with other types of gamblers, the Investors remember the Big Wins and hope for those to happen again, unlikely though they may be.

What of the brokers? In these cases, the Brokers are the House and they are creating a House Edge of God-knows-what that you are bucking. I haven’t taken the time to thoroughly study short-term market fluctuations, (other than half of one course at University that was dedicated to that) so I cannot look at a particular event and quantify the disadvantage. I know that there IS a disadvantage, and if I am the one at the disadvantage, that is all I need to know, no thanks!

The process itself, much like watching a Sporting Event upon which an individual has money can be really exciting, especially if there are huge (relative to the Investor) amounts of money to either be won or lost. For example, the Investor might spend days with one eye on the Oil Prices and one eye on whatever else he is doing hoping that they either do or do not rise or fall below a certain level much as an individual might watch the Super Bowl, but be primarily concerned with whether or not there is going to be a safety in the game.

In other words, it takes something that would otherwise be inconsequential to most people, (for all of the armchair cheering I did for the Penguins in their run at the Stanley Cup, I stopped really caring about twenty-seven minutes after the game was over) and makes it a life-or-death matter (metaphorically, I hope) during which a lot of money stands to either be gained or lost. It is this constant watching of the event unfolding itself that can become addictive and sets the centers of the brain that release adrenaline, dopamine and endorphins on overdrive.

In that sense, it is just as possible for an individual to become addicted to Binary Options just as an individual could become addicted to Sports Gambling or any other form of gambling. As with an individual addicted to Sports Gambling, the individual will constantly make excuses and attempt to look for outlier-type reasons that he lost, rather than having the ability to admit that he sucks and made a bad bet.

If the offshore Binary Options do not sound bad enough after all of this, then one should keep in mind that I have, so far, only discussed people acting in accordance with their own free will and volition. However, how much worse would all of this be in the event that someone were coerced into it with false promises and guarantees?

Let’s Talk About Telemarketing

I want to take a moment now and inform everyone that I once worked, both as a, ‘Telephone Sales Representative,’ (read: pain in your ass) as well as a Supervisor of Telephone Sales Representatives and I am here to relate to you some of the shadier things that happened with respect to that occupation. Please keep in mind, as I realized some of the things that were going on throughout my employment there, I made increasingly active attempts to find alternative employment, but it was not a huge concern.

In terms of defending my moral positions, I just want to say that I am not sure if this has come down to my life experiences specifically with respect to employment, or whether this is actually the case with every single person other than those self-employed, but shady stuff (though the degrees vary) occurs with pretty much every employer on Earth.

Actually, LCB/WOO/WOV is an exception, as far as I know! I’m treated extremely well! Oh, and when I carried newspapers as a kid, nothing wrong there.

The point is, in every place in which I have physically worked, there have been certain ethical or health codes broken in ways that vary only in terms of their deliberation or how flagrant, but undoubtedly, different standards have been broken everywhere. I am going to go into some detail on a few of the telemarketing ones, but before I do that, let me give some brief examples from other jobs that I have had:

Grocery Store Deli: If an item ends up being outdated based on the time that the package was opened (they have to be labeled at all times) simply take the old label off of it and put a new one on that makes it good for another three days to a week, your choice.

Grocery Store (All Departments): If there is an item that expires for which we get credit for damages, but not expirations, then damage the item and put it in with damages so we get the credit.

Tennis Court Supervisor: I actually don’t have any examples here, although, when I got moved down to Park Operations, myself and many other individuals under the age of 21 were the beneficiaries of alcohol given to us by one manager or the other at various times and for various reasons...usually upon completion of a major task. I’m not saying that I had any problems with these events, per se, I’m just saying that all of these occurrences were highly illegal and made that much worse by the fact that we were working for a State Regulated Park Commission at the time.

Oh yeah, and one of the Managers sexually harassed almost every female within a square mile of him at almost every opportunity. He was also a pretty goofy looking guy too, so that probably made it a little worse, but I’m not sure.

Janitor/Bartender: Water down the liquor, they watered down the liquor!!! Also, my manager also essentially quadrupled her salary without the consent of the owner because he was out of state for a few months. Furthermore, when she eventually decided to pay me cash because I refused, at one time, she offered to have me on the clock while watching her kids and transporting them from place to place. Or, maybe they were her daughters’ kids, I really don’t remember whose kids they were. In any event, I offered to watch them for cash instead, which she paid me, out of the salary that she quadrupled in an unauthorized way.

Furniture Sales: Oh. My. God. I have never lied in one place more in my entire life than I did in that furniture store and on the phone with customers. Because I had to. And, that includes the telemarketing job.

Hotel #1: This hotel actually handled things in a pretty straight up way, as far as I managed it and with respect to how I was told to do things. We probably had a couple relatively serious building code related things that I couldn’t compel the owner to anything about until they were actually cited by the County in a property inspection...but if that’s the shadiest thing going on in a hotel, then you work at a pretty decent hotel!

Hotel #2: Don’t get me started, just don’t.

Therefore, my conclusion is that shady stuff happens everywhere or almost everywhere, fortunately, ‘Truth is a defense,’ so I am actually going to be able to get into some hardcore specifics on the third of three telemarketing-related accounts that I am going to relate for your entertainment and pleasure!

By the way, when I supervised, if it tells you anything my team’s motto was a semi-serious, ‘If you ain’t lyin’, then you ain’t tryin’.’

1.) Fake Dispositions

For those of you who are not up to spec on your telemarketing parlance, well aren’t you lucky? In any event, a, ‘Disposition,’ is simply something that goes into a computer (and, sometimes, even into a client’s file) at the conclusion of a call simply stating what happened on that call. These dispositions can be anywhere from someone being put on the Do Not Call list to a Refusal, to an Irate customer who did not specifically request to be put on the Do Not Call List (that person is getting another call, by the way) and, on rare occasions, a sale.

Dispositions are a bit different when it comes to a, ‘Political,’ campaign, though. Political campaigns are those calls you love that are exceptions to the Do Not Call list in which an individual calls you either to give you a, ‘Brief,’ (scoff) survey or to throw a spiel at you to try to compel you to vote for someone in a district, and usually state, that typically has absolutely nothing to do with the caller. It’s for that reason that if you say anything about the candidate that cannot be somehow answered with something on the script, the person who called you is going to often hastily get off the phone.

Anyway, we were working a Political Campaign where there was a certain bonus the company would get if it actually reached enough contacts in order to get surveys completed. I cannot explain what happened, but it was an excellent day in Minnesota (we were calling from West Virginia) for the desired person not to be home, so slightly dejected, the company failed to achieve the Bonus.

Yeah, right!

What the company told everyone to do was to simply go through hang-ups, at certain times, as if they were actually completing the surveys because the calls were not being recorded, anyway. In order to do this, the Supervisors had to go around and have particular individuals being call monitored inside of the building because, the way the system worked, outside monitoring could not take place on that Telephone Sales Representative if internal monitoring was going on. During these times, the TSR’s who were being monitored internally would go through and arbitrarily select answers (they were told to try to keep it roughly equal) to the survey questions and then disposition the call as though an actual survey had taken place.

Fortunately, no names were published along with survey results, so the people we were supposed to be calling were in no way harmed by any of these proceedings, but the company I worked for patently ripped of the entity that contracted us to do these surveys.

2.) We’ll Save You On...No, We Won’t

Another shady enterprise, which was actually so shady that OUR company decided to renege on the Contract was one that involved a certain energy company who promised, ‘Fixed,’ rates per Kilowatt Hour if you switched to them which promised to offer an 18% savings over the long-run, on average.

That seems enough on the square, but let me assure you, if you ever get a call that has anything to do with your energy rates, unless that call is coming directly from your utility provider, the answer is, ‘No,’ every single time. What this company essentially did was offer extreme savings over the Summer months, (when you are actually using less energy in the Winter areas to whom they were Marketing) but during the cold season, the rates were actually much higher.

That company actually provided us with documentation with respect to what their rates were for each individual month over the past year, but it said nothing about the average rate for the utility provider themselves. After looking up that information, I determined that the customer (in the event that they agreed) would pay about 20% MORE over the course of a year, and the average savings over the Summer could only be said to be 18% when seriously cherry-picking the data. The worst part is that the specially, ‘Discounted,’ rates for the first three months were actually still more than the average rates from the utility provider during the Winter months...and this campaign rolled out in September and was scheduled to last until January.

In other words, anyone who signed up to receive the energy from this company saved absolutely nothing, ever, period end of story. Further, they would never save anything during the time that this would be sold because the only savings would come during the Summer months after they had already been price gouged over the Winter.

When an independent telemarketing company is saying, “No, we absolutely cannot do this,’ you have got some problems!

3.) Discover Financial Services

Identity Theft Protection, to be specific, and yes I can mention them by name because they were actually investigated by the Consumer Financial Protection Bureau and the Federal Deposit Insurance Corporation and forced to refund 200 million dollars to customers due to deceptive Marketing practices:

http://money.cnn.com/2012/09/24/pf/discover-penalty-telemarketing/

The Identity Theft Protection, as well as other services, according to the report, were found to be misrepresentative of what was being offered because the investigation found that Discover actually Marketed them in a way that strongly lent to the impression that they were fee-free services, when in reality, they cost anywhere from $2.99-$12.99 per month depending on the service in question.

I can actually get a little bit more in-depth on this by way of personal experience and state some things that you will not see in the Article:

Basically, Discover’s Scripted, ‘Pitch,’ of the product (which we absolutely never used unless on a client session with Discover listening) was a poorly worded piece of utter trash that did not mention the price in any way whatsoever. What those agencies accuse Discover of doing is essentially using these pitches that would seem to indicate that the service is free and then, ‘Slam-Scripting,’ the client through the authorization to the charges (with did mention the price) by way of reading as fast as possible.

What’s actually kind of sad about this is that all of the Discover scripts, most of which did not mention the price, would be insufficient to sell water in the deserts of Nevada in mid-July. In the scripts that I used, and later composed, the price was always mentioned at the end of the presentation, because if not, then the customer would instantly balk at hearing the price. IN our case, it is true that we read the disclosure quickly, but that was actually because we had disclosed the relevant information (with respect to the price and cancellation policy, if any) and were simply trying to get through the disclosure quickly to move onto our next call and potential sale.

Of course, another detrimental aspect of this telemarketing is that the person in question did not have to do anything whatsoever to verify their identity to consent to the purchase other than to not specifically tell us that they were not the person that we asked for. While rare, as a result, you would occasionally have what sounded like children on the line accepting a sale on behalf of the parents, but an agent had no choice but to put it through, because you couldn’t really accuse the person of being a child...and I think we all know what would happen if one of the agents completely let a sale go.

With that said, I will say that Discover has reformed and I have no idea what their activities may or may not be with respect to Outbound Calling, but their Inbound Customer Service Representatives, in my opinion, are outstanding and well-trained for the most part.

In any case, hopefully that got my point across that telemarketing is a shady as Hell industry. What does that have to do with Binary Options, though?

Telemarketing and Binary Options

When it comes to Binary Options, there are a number of Internet and Telemarketing sales firms out there whose goal is to acquire new investors. In the vast majority of these companies, in addition to base salaries, the representatives will also make commissions. These companies, of course, are not based in the United States because Binary Option trading must be done on an actual exchange in the United States, so as a result, these companies abroad would not operate out of the United States largely due to the increased labor costs.

As with any other telemarketing job, inside or outside the United States, they are relatively easy to get but are, by no means, ‘Stable.’ Very often in the telemarketing industry a fundamental ability to communicate somewhat effectively will be all that is needed to get your foot in the door, so the telemarketing industry will often hire all-comers and weed out the ones who do not perform well (or have strong moral objections) at a later time. Of course, there is some degree of short-term Variance that might result in a person with potential being terminated from his or her job simply because he or she did not meet the sales goals for the first few weeks of employment. While I cannot say whether or not that specific aspect is true with respect to Binary Option Telemarketing, I suspect that it probably is.

Anyway, for those who are not particularly well-educated, or fairly desperate for a job, the telemarketing industry (both in the United States and abroad) pays more, at least, than most of the lowest-level positions that are out there. It is certainly a more comfortable environment, and pays better, than flipping burgers, just for one example. That is pretty much a Universal truth of telemarketing.

The other Universal truth with respect to Outbound Telemarketing is that you will probably find yourself doing something shady, and the Binary Option Sales Reps are about as shady as it gets. With the Binary Option industry overseas, the goal of a telemarketing firm (much like an Online Casino...only the Binary Options are ALWAYS shady) is to get the customer to put down a certain minimum deposit with them and then to make Binary Option trades until all of that money is gone and the client needs to deposit again.

In many cases, the customers will phone in or go on the Internet when they want to put up a certain amount of money to trade on a certain position, so these telemarketing agents also act as representatives in terms of actually getting the Option purchased from the broker. Many of these agencies tend to deal with the high/low fluctuation trading as well as range trading due to the incredible disparity between what is offered and what would otherwise constitute a, ‘Fair Line,’ so to speak.

Obviously, as with many other Telemarketing firms, Binary Option Telemarketing firms teach their representatives a litany of high-pressure sales tactics designed to prey upon psychological weaknesses, or to appeal to people (case-by-case) just to keep them on the phone.

I cannot pretend to know specifically what these Binary Options companies teach their people, because I have never worked for one, but I imagine it is roughly similar to some of the concepts we were taught. While I am not going to go into the list of every single concept that was taught at the telemarketing company for whom I was employed, here are the worst five:

1.) Remember, some people are TOO polite to hang up the phone.

This is actually a useful one for some people who had no respect for the limits that our company put on rebuttals during a given phone call, and that is simply using the tendency of some people being too polite to hang up the phone against them. Despite whatever the person may say and whatever verbal cues he or she may give, regardless of the person’s complete and total lack of interest in the product or offer, some people simply cannot bring themselves to hang up the phone.

The goal in this type of scenario is to eventually hammer the person to submission by way of keeping them on the phone so long that they realize the only way they are getting off of the line (other than hanging up, which is not acceptable to them) is to cave in and eventually buy whatever it is you are selling. These people are certainly a significant minority of the population, but they do exist, and this tendency is one that can be exploited.

Fortunately, we did have internal controls in place by which we would not allow our TSR’s to, ‘Badger,’ the customer. We demanded that there be anywhere from two-three rebuttals and one probing question per call, (provided the person didn’t hang up by then) but anything over and above that was construed as badgering and was subject to disciplinary action.

Of course, that doesn’t mean that individuals with this tendency could not still be taken advantage of. While the TSR’s were limited in how many rebuttals they could employ, they were free to rebut for as long a time period as they wanted to, so the goal some of them had was to just keep talking without giving the customer a chance to cut in with an objection, (someone too polite to hang up is also too polite to interrupt) until it finally sounded like the customer was ready to relent and complete the sale...often because they had somewhere to go.

2.) Misrepresentation

Strictly speaking, we did not teach misrepresentation, not usually, anyway. Unfortunately, we only punished the most severe and blatant acts of misrepresentation and if a supervisor even wanted to admonish someone for misrepresentation in the form of disciplinary action, then that Supervisor had to clear the action with the Shift Manager, first.

Also, everyone is familiar with the concept of implications, so obviously, there are many situations in telemarketing where an individual can phrase things as though he/she is saying something completely different while still, technically, telling the complete and total truth.

3.) Verbal Cues

This one doesn’t sound particularly shady, until you look at the fact that we were actually trained on how to make assumptions (often correct) about a particular customer’s psyche based on the sound of their voice. For one thing, we were encouraged to generally, ‘Mirror the customer,’ because people are often most comfortable with those who remind them of themselves with one notable exception: people who sounded meek.

If a person was extremely quiet on the phone, then we were taught to completely unload on them. That does not mean that we were supposed to be loud, but we were taught to adopt extremely aggressive sales tactics with these people because they would be the most likely not to argue and to simply go through with the sale.

For my part, I spoke to same to just about everyone and was consistently one of the sales leaders...I don’t need dirty tricks to sell! Although, I did need to teach a few of my reps a couple dirty tricks in order to have my team meet their goals as supervisor.

4.) Slam Scripting

This is simply where you go through your presentation and disclosure so fast that the customer is unlikely to really have much of an idea what is going on. In fact, if you are forced to stop and get a response at some point in the recorded presentation and the customer says, ‘Huh?’ then the representative will simply respond with, ‘I’m sorry, was that a yes?’ and most people will just automatically respond with a yes. Boom. Sale made, albeit a shady sale.

5.) Strawman Arguments

Honestly, this was actually one of my favorites to actually use when rebutting on occasion because I do not consider it an unfair sales tactic. Basically, all you would do when selling an insurance type product, after the initial objection, is to come up with the absolute most worst-case scenario you could and counter with that as an example of why the insurance type product could prove important. It did not necessarily have to be a terribly likely event, and, in fact, was almost certainly not, but many people have a natural tendency to fear the worst when it is presented to them and a simple, ‘Outside the norm,’ scenario might be enough to swing them your way.

While not all of these tactics would be applicable to the Telemarketing of Binary Options, certainly you can see that there are many shady aspects of the Telemarketing industry and, therefore, there are probably a great many shady tools available at the disposal of these telemarketers. With a comparative lack of regulations, outright lying about the results of other Investors is probably not at all unusual as well as pitching things in such a way that profitable investing would seem easy to the uninitiated.

There are other regulations in the United States that do not apply abroad, as well. For example, United States customers are guaranteed certain protections such as the inability of a telemarketing agency to call them more than twice in a given day, as well as the fact that there has to be so many hours between calls. Furthermore, telemarketers in the United States are absolutely obligated to give their correct names, first and last if asked, to the customer whereas overseas callers (even those calling the United States) are encouraged, sometimes even ordered, to use fictitious names. I don’t mean to make any assumptions that some people would consider out of character for me, but if every person with a clear Arabic or Middle Eastern accents that has ever called me for a sales-related reasons was actually given the name, ‘David,’ or, ‘Bob,’ I’ll eat my own hat.

In this sense, at least to something of a Psychological degree, the person who is doing the telemarketing feels as though he or she is in someway accountable for what he or she is doing. The telemarketer in the United States cannot hide behind a fake name, fake location he is calling from, or fictitious company doing the calling as the regulations all mandate that those questions, if asked, be answered completely honestly.

If telemarketers abroad are permitted to lie about something as fundamental as their name, or if not strictly permitted are apparently able to generally get away with it, then just imagine what other things they might be lying about on a given phone call. For example, when selling actual credit cards, we were strictly prohibited from offering any financial advice or holding ourselves out to have any financial knowledge, degrees, experience or certifications that we did not actually have. When it comes to people calling from other countries to other countries, however, maybe it is possible that some of these rules do not apply, or rather, are not applied. In essence, these people could be telling the potential customers anything, or alternatively, holding themselves out to be experts or certified in ways that are absolutely not true. Simply put, they can say absolutely anything.

It does not matter if you are in the United States or abroad, though, following one simple rule will help you now and for all time:

UNLESS YOU MADE THE PHONE CALL, DO NOT GIVE ANY OF YOUR INFORMATION!!!

If you follow that simple Rule, then you will find the process of dealing with telemarketers much easier. Obvious exceptions to that rule would be if you clearly recognize the vice of the caller or if you are getting a call back from a particular company or agency.

It is undoubtedly the case that these representatives are going to portray themselves as having experience and expertize that they absolutely do not have, and moreover, that they have the interest of the customers at heart. They may not be upfront in disclosing how they, or the agency for whom they work actually profits. They might try to suggest that the simply act as middlemen of sorts and receive a commission for facilitating the transactions, when in actuality, the agency for whom they work may be directly connected to the brokers who come up with the Investing Binary Option Bids and Offers (or whatever is the case) or the agency might actually be the broker.

In many of these cases, then, the representative may be compensated, in part or in whole, based on how well is able to convince you to invest your money with him, and ultimately, he may be directly receiving a cut of how much you lose.

Even if You Win, You May Lose

What we know at this point is that the deck begins stacked against many Binary Option Investors abroad, and now, that deck is in the hands of the representative and he is doing some fake shuffling! However, let’s say by some miracle you actually manage to overcome the insurmountable odds against you and make some money.

Everyone reading this site has either experienced disreputable Online Casinos or has read stories about disreputable Online Casinos who engage in slow pays, no pays, or delayed withdrawal tactics...and it is almost a guarantee that these Binary Option companies are going to do much the same. The first thing that they will do is subject the customer who wants to withdraw their funds to a detailed information-sharing process by which the customer has to go to great lengths to prove his or her identity (obviously, I’m talking about lengths much greater than most Online Casinos) which may also include the sharing of personal information (in the case of the Binary Option companies) that could theoretically later be stolen and used for illicit means.

Even after that entire process is completed, that does not necessarily mean that a profitable investor is going to get paid. One thing to keep in mind is that many of these companies are located abroad (relative to the Investor) and might even be shell companies who, above-the-board, do not even operate under the name that they claimed to while dealing with the client. Even if the company is operating with the client under its legitimate name, there still might be a bunch of legal loopholes to jump through that make collecting in the event of a no pay difficult, if not impossible.

In essence, a company of this nature, having burnt its name out and theoretically after getting trashed all over the Internet, can simply change its name and go on as if nothing happened. In fact, some of the Investors might fall for the same company on multiple occasions, at least, what is effectively the same company, just operating under different names.

The long and short of it is, there is little to no recourse if a particular agency decides not to pay you even if you have made successful Options plays. The best way to go about it is to either seek an above-the-board and regulated agency within your own home country who has a long history of being a credible source for the Administration and trading of such contracts, or simply, not to do Binary Options at all. Certainly, you do not want to attempt to do anything with a company that has called you, much less give any personal information, and would do well to only stick to companies (if you must do it at all) to whom you have personally reached out.

In the meantime, resorting to such tactics is generally not going to be the first resort, and that is true anytime a customer tries to cancel a business relationship over the phone, even in the United States. Usually customers that attempt to cancel any service, even if such was advertised as able to be canceled with, ‘No questions asked,’ are going to have an agent whose specific job it is to rebut your problems with the service, offer alternatives, and ultimately, try to keep you as a customer. Delaying your withdrawal, in that effect, is not the first thing that these companies want to do, what they really want to do is first get you to lose any money you have remaining with them, and then to deposit more money.

With respect to Binary Option trading, the person in question may offer you advice or investment strategies that are, ‘Guaranteed to be profitable.’ They may tell you something that, ‘They are not supposed to,’ or, ‘Wouldn’t tell just any other customer,’ in order to compel you to continue to do business with them. Once again, if the customer is getting screwed over but does not believe he is getting screwed over, that will give these companies a golden opportunity to screw the customer over even harder and longer.

If that weren’t enough to turn your stomach, there is even more to it than just that. The companies who engaged in the Binary Option trading might go as far as to accuse the customer of defrauding THEM, usually by way of some shaky stipulation of which the customer was not previously aware, in order to avoid paying any monies due the customer. In some cases, the company will not even do the customer the nicety of even bothering to lie to them about the situation, but rather, will simply stop speaking to the customer at all about the matter.

There is no wallet to be left unturned in this industry provided the customer has sufficient funds to make the deposit, of course. Furthermore, these companies are definitely not as scrupulous when it comes to accepting a deposit as they are about making a withdrawal. In fact, making a deposit is usually as simple as whipping out one’s piece of plastic and giving the information. While it may not necessarily be common, keep in mind that these companies also now have access to some aspect of the customer’s financial data and might now use that information to defraud the customer in other ways such as taking money that was not authorized by the customer, the sale of the customer’s information, or having a different company transact a, ‘Sale,’ using the customer’s information with or without the customer’s permission.

Unfortunately, these types of incidences are hardly unusual abroad, and if we are to be honest, not even completely unheard of inside of the United States. The gathering and selling of personal information is a somewhat lucrative industry, of sorts, for some people who are completely unscrupulous, so it would come as no surprise if an agency who is already committing wholly unscrupulous acts against its so-called clients would also commit other infringements upon them.