There is a new way to bet Sports without actually betting Sports that has recently been legalized in the State of Nevada and is fully legal for everyone in the United States to participate in as well as, presumably, denizens of many other of the world’s countries. However, if there are any general provisions in your country related to placing investments in the United States, or any requirements as it pertains to the reporting of same, obviously, that is not knowledge that I would readily possess on a country-by-country basis, so I would strongly advise you to look up any statutes or regulations that may be applicable.

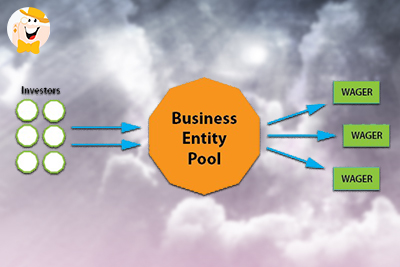

However, while I said you are, ‘Betting,’ on Sports, that is only strictly true. With the new concept of, ‘Entity Wagering,’ you are actually acting as an, ‘Investor,’ in Sports Betting and you have no control over the process of which bets are selected in any given matchup, or even what matchups are going to be bet.

The WIRE Act, at least for citizens of the United States, makes it illegal for an individual to place interstate Sports Bets, which is largely the reason that Sportsbooks in Nevada will not disseminate any information related to Sports Betting Lines over the phone. It is for that reason that you do not have any (above board) individuals or entities in the State of Nevada with whom a bettor in another State could simply place money and then tell the individual or entity where to go, what to bet on and then have the individual or entity simply charge a, ‘Service Fee,’ for managing the money as well as placing the physical bets.

In actuality, that sort of thing probably happens quite frequently, but it is typically a more, ‘Under-the-table,’ type of arrangement because an individual generally must be in either the State of Nevada or State of New Jersey to either, ‘Call-In,’ or physically place a wager on Sports or Racing.

Entity Wagering, as stated, is different in the sense that the, ‘Investors,’ are not in any way permitted to have an impact on what gets wagered, and honestly, most of the individuals calling the Wagering shots for the entities would not want them to, anyway, because they purport themselves as expert handicappers who know what they are doing. The idea behind Entity Wagering is that the individual (or group) is going to invest the money, the head of the entity is going to place winning bets, and the people who invest in the entity are going to get a cut of the winnings.

In this Editorial, we are going to take a look at Entity Wagering in the United States, which took the first active wagers on March 31st of this year. The first thing that we are going to do is take a look at exactly what it is, how it works, and why it is supposed to work, and then we are going to explore the pros and cons and attempt to answer some questions as relates Entity Wagering.

Furthermore, I actually conducted an interview with the heads of not one, but two, major Entity Wagering firms that have enjoyed early success on our sister site, WizardofOdds.com As soon as the page containing those Interviews is posted, I will provide a link to said page in the Comments, so please stay tuned and check this Editorial every couple of days or so for that.

What is Entity Wagering?

In a nutshell, Entity Wagering is simply, ‘Investing,’ your money with one or more of the licensed Nevada Wagering Entities who will then take those funds and place them on whatever Wagers they see fit. If they do well, then you do well, if they do not show profits, then you lose money.

As mentioned before, the Investor does not (even if in Nevada) and cannot (if outside of Nevada) have any direct input over what gets bet. In fact, for players who want to know what was bet as soon as possible, the Entities generally will not let them know about it until the Lines close. According to Ken Murphy of Nevada Sports Investment Group, some of his clients do not even care to know as soon as a Wager is made and would prefer just to receive their monthly reports.

While the Investors may not necessarily invest equally (by which, I mean, some Investors may have more money with the entity than others) the results of all Wagers must affect all Investors in a strictly proportionate way. In other words, if six people have total investments of $100,000, and the event in question is one the Entity believes is appropriate to invest 1% of the total fund under their control, then an individual with $25,000 invested (25%) would either win or lose $250 (assuming Even Money) of what would be a $1,000 Wager (1%).

Different entities have different terms with respect to when an Investor may withdraw his/her/their money, but regardless of what those terms are, any monies Wagered (and won or lost) will impact the entire amount of the fund at that time in a Proportionate manner.

How Can I Become an Investor?

Becoming an Investor is a relatively simple process, in most cases. When you have found an Entity with whom you would like to do business, then you will simply provide them with some basic personal information such as name, proof of address and you will also need to disclose what the source of your funds that you are investing is. While the latter part may seem unusual, keep in mind that this is a completely above-the-board process and the main reason for this last requirement is to ensure that there is no money laundering, bank fraud, identity theft or outright stolen money going through these Entities.

Furthermore, a group of individuals may choose to come together to form a Partnership, LLC or Corporation and, as a business, may choose to have their business invest money with the Entities. One thing about this is that it cannot be used to circumvent the income verification process as EVERY individual within that particular group must be approved as an Investor. In other words, the Group, even acting as their own business, will have to essentially individually verify where the funds they are investing came from.

Furthermore, many of these entities require lesser minimum deposits than others, so many of the entities with lower minimum deposits may not be inclined to accept groups. For example, and Entity willing to accept a Deposit of only $500 (the lowest I have seen) would probably not be too keen on having twenty different people form an LLC and each deposit $25. That’s a lot of paperwork and verification for a relatively small deposit!

In fact, the first that I heard about the ability for people to form a group of any kind and invest as such came from my interview with Ken Murphy on NSIG and that might be because the Minimum required deposit for his Entity is a seemingly steep $25,000.

Now that we have a general idea of how the Entities work, let’s take a look at some questions as well as some Pros and Cons of getting involved as an Investor?

What is the Difference Between an Entity and a Tout Service?

There are some major differences between Entities and Tout Services. The first of these differences is the fact that the Entities are betting your money more or less directly whereas the Tout Services simply, ‘Sell,’ what they purport to be winning Picks. In both cases, the goals of both the Entities and the Touts are to make advantageous wagers and ensure profits to the people that pay for their services.

Generally speaking, I would totally avoid operating with any touts whatsoever whereas I am on the fence on whether or not putting your money in with an Entity could potentially be a good investment. With that said, I will attempt to be as impartial as possible in looking at the Pros and Cons of Wagering Entities as opposed to Touts.

Choices: When it comes to Touts, individuals are paying directly for the Picks of the Touts which the Touts claim, obviously, will result in a profit. When it comes to paying for Tout Services, one should keep in mind that not only does the tout (and, therefore, the bettor) need to pick well enough to beat the vig (read: House Edge) that the Sportsbooks inherently have when they set their Lines, or at least, attempt to have, but the Bettor must also be able to beat it to enough of an extent that the fees they pay for the Picks of the Tout are also covered.

With that said, when it comes to getting Picks from a Tout, the prospective bettor at least has the choice of whether or not he/she wants to go and bet the Picks that the Tout has provided. Obviously, if the Bettor does not have a positive opinion of an individual tout’s pick on a particular side, then the person has the option of simply not putting any money on that pick.

Wagering Entities are entirely different in this sense because the investor’s money is locked in and the Entity will place whatever wagers they like with that money. Due to the fact that the Investor may not have any input with respect to the actual betting, the Investor, by definition, cannot choose to side with the Entity or, ‘Opt out,’ of a specific selection. In fact, individual Investors are not aware of what a Wagering Entity has done until they have already placed the Wager, because they are not informed of the Wager until after the Lines have closed.

Furthermore, a Bettor may use a wide variety of tout services...provided he or she wants to pay for them all and then could make, ‘Consensus bets,’ in the case that enough touts that the Bettor trusts (snicker) agree on a particular side. With respect to Entity Betting, while the word, ‘Entity,’ would seem to imply the involvement of more than one person, that is only true in the sense of the investors...in many cases, including the cases of two of the most successful Wagering Entities that I have had the pleasure of talking to so far, it is actually just one person calling the shots with respect to the sides that are taken.

Another choice that someone betting alone or betting with a tout service can make is how much of his/her bankroll to stake on a particular side. While it is not an intelligent decision, an individual with an extreme amount of confidence in one side of a line could theoretically place everything that he/she has on that side. Furthermore, an individual might choose to devote no more than one half of one percent (or even less) on any given Line regardless of the Bettor’s degree of confidence.

When it comes to Entity Wagering, the individual in question does not have any direct control over how much of the, ‘Fund,’ gets invested on a particular side. The majority of Wagering Entities, however, have confidence in their ability to yield long-term profits for both themselves and their Investors and will apply the Kelly Criterion, or perhaps other betting metrics, when deciding how much to bet.

Most such Entities will make it clear on their respective websites how much of the total fund they are willing to risk on a given proposition. Two examples are NSIG who states that they will only invest 1%-3% (with 3% being quite rare) of the total fund on a particular side and 1% actually being closer to the average compared with an entity such as Contrarian Investments who, using the Kelly Criterion, have determined that the Optimal Wager with them ONLY picking sides they perceive as extremely strong is 5.3%, and effectively, they wager 5.5% of the total fund on essentially every side that they take. Many entities will fall somewhere between these two percentages, so depending on how much risk you want to take and how much Confidence you have in a given Entity after researching them, you would have to decide what level of risk you are comfortable with.

One aspect of this that I would point out when it comes to a certain percentage of the fund being Wagered is that such also directly represents the portion of your personal Investment that is wagered on a given side. That is obviously due to the proportionate nature of the Wagering, so if you have $25,000 deposited into an entity and a total of $20,000 is wagered which represents 5% of the fund, then obviously, not all $20,000 of that is coming from your money.

Those are the major differences between a Tout Service and Entity Wagering. While Tout Services emphasize trying to Pick winning sides and pick at an advantage, (other than the absolute shadiest operators who shell out conflicting Picks or otherwise literally do not care at all what happens to their subscribers) a large percentage of the profits for the Entities and those that run the Entities or work within them are predicated upon winning, and in some cases (and the ones I would be more likely to invest with, if I were inclined to invest at all) they essentially do not win unless you do.

With all of that out of the way, let’s take a look at some of the fee structures that are in place:

Fee Structures:

With respect to the fee structures, different Entities also have different terms with respect to the fees that they charge for their services. Almost invariably, and I would expect it to continue to be so, either all of or most of the money a Wagering Entity makes comes from, ‘Performance Fees,’ and what those are is monies that are paid only if your Investment shows a profit. These fees can range anywhere from the lowest I have seen, which is 10%, to the highest I have seen, which is NSIG’s 30% Performance Fee.

However, it is not sufficient to just look at the percentage of, ‘Performance Fees,’ when choosing an Entity. There are other potential fees and factors involved, as well. The first thing that you want to look at is how transparent is the Entity when it comes to advertising the sides that they have picked? Personally, I would not want to just count on Win/Loss records alone when it comes to choosing an Entity because they can be misleading.

The reason that I say this is because you can take a look at NFL Betting, and most people bet Point Spreads in the NFL by which one team will, ‘Lay,’ points while another team will, ‘Get,’ points. For example, imagine that the New England Patriots were scheduled to play the Buffalo Bills and the Line was Patriots -7: If you wanted to bet the Patriots, then you would not simply be saying that the Patriots will merely beat the Bills, in order to have a winning bet, the Patriots would need to beat the Bills by more than seven points whereas beating them by exactly seven would result in a Push. (Tie) If you wanted to Pick the Bills in this scenario, the Bills could either win or lose by less than seven for you to have a winning bet whereas them losing by exactly seven would be a Push.

This is relevant because another way this game could be bet on is called the, ‘Money Line,’ and what the Money Line is entails the Bettor picking one side or the other straight up. As anyone could imagine, when it comes to a spread of -7, that means that the New England Patriots are considered a heavy favorite to win that particular game. As a result, if you wanted to pick them to win on the Money Line, you would have to bet significantly more than $100 in order to win $100. According to this table:

http://www.sportility.net/nfl/moneyline_points.html

A Bettor would have to Wager $305 to win $100 picking New England straight up (or any other team for whom the Money Line is -7) in this situation.

The reason this is relevant is because either a tout or an Entity could use these, ‘Straight,’ bets on heavy favorites in order to seriously pad their winning percentage. As you can see in the example above, an individual making this Wager stands to lose $305 in order to win $100. In other words, they stand to lose more than three times what they will make if they are wrong compared to if they are right. Let’s take a look at someone with a 75% success rate picking these games:

(100 * .75) - (305 * .25) = -1.25

In other words, if you picked the winner successfully 75% of the time, which could theoretically represent as many as 100 bets, then you would have a, ‘Win/Loss,’ record of 75-25...which would be amazing on its face...except for the fact that you have lost $1.25 ($125 overall) on every single bet you have made in that 100 bets, on average.

The point of all of this is that any service can use this sort of betting, in whole theoretically but certainly in part, to, ‘Pad the stats,’ and show an impressive win/loss record. However, a few of the Entities that are out there now report their results as soon as they happen, so that the individual bets can all be looked at and the Win/Loss records placed in the proper context. NSIG and Contrarian, for example, are two Entities that have posted their exact Picks and, at least so far, have shown some promising profits.

If I had interest in becoming an Investor in Entity Wagering, it might be perhaps more essential than anything that the Entities that I would shop make transparent their specific bets BEFORE I became an Investor. There are some Entities who may choose not to publicize their sides or results at all, or to me, even more alarmingly, only choose to make apparent their win/loss records.

I would also want to have access to the individual bets that an Entity has made to ensure that they are not, ‘Playing the Variance,’ to attempt to show a profit at any given time and only publicizing the return to investors. What I mean by this is that they could simply, ‘Ramp up,’ their bets, similar to a Martingale System in concept, in a manner designed to show profits while, in actuality, they actually have a poor win rate. Therefore, I would be inclined to only shop around on Entities that have made their specific bets transparent in terms of results and amounts bet on each particular side.

It is natural, however, that these entities may occasionally Wager more money on certain sides and a lesser percentage of the total fund on others predicated upon whatever advantage they perceive themselves to have on a particular wager. This is not only natural and logical, but for Entities that operate under the Kelly Criterion (or some similar concept) the Wager Amount is largely predicated upon whatever they perceive their percentage edge to be because that is how it is supposed to work.

Back to the fee structures, though, Contrarian has a fee structure in which there is only one upfront charge, which is a $50 fee on deposits. I do not necessarily have a problem with this fee because I almost look at it as a, ‘Service Fee,’ that is traded for the right to make a smaller deposit. Obviously, NSIG, who requires a minimum deposit of $25,000, do not have any fees of this nature. The deposit fee may also be used to encourage people to make larger deposits as winnings (expressed as a percentage) will more quickly overcome that initial Deposit Fee if an individual makes a larger deposit.

For instance, an individual who wishes to have an Investment Account Balance of $1,000 would have to deposit $1,050 in order to have $1,000 after these fees. After taking into account the, ‘Performance Fee,’ the individual would have to win 5% of the initial investment in order to have just made the Deposit Fee back. Obviously, the larger the deposit, the lesser the percentage that needs to be won in order to overcome the Deposit Fee.

One entity that I looked at only has a 10%, ‘Performance Fee,’ on winnings, however, they require a 2%, “Management Fee,’ on any monies deposited which comes out immediately. In this case, an individual depositing $2,500 would be paying the same amount in upfront fees whether it be in the form of the, ‘Management Fee,’ or the flat $50, ‘Deposit Fee.’ I would personally choose Contrarian if this were my situation, though, only because I believe they make their results more apparent prior to any investments being made. If an individual were considering depositing any amount greater than $2,500, then, the flat $50, ‘Deposit Fee,’ would be less than the 2%, ‘Management Fee,’ of that other entity.

For those of you with the money to invest, if you have confidence in the effectiveness of any given Entity, then this might be a good time to get in while the Entities, and actually, the entire process of Entity Wagering is still young. The reason that I say that is because many of these Entities have openly stated that they anticipate their minimum deposit requirements will eventually be increased. I would assume the reason for this is because they anticipate they will show strong long-term results, and as such, they will be able to command greater minimum deposits after having a proven track record of past success.

When it comes to the, ‘Performance Fees,’ those might also work differently from one entity to another. For example, NSIG does their, ‘Performance Fee,’ of 30% of any profits on a Quarterly basis with a, ‘True up,’ after the Fourth Quarter. What that means is that an individual will pay 30% of the profits to the Entity after every Quarter in which there are profits while paying nothing on losing quarters, if applicable. However, after the fourth quarter of a given year, if that is a losing quarter (or if that quarter and a quarter prior to it have been losing quarters) than any monies assessed as, ‘Performance Fees,’ from prior profitable quarters will be returned to the client’s account and the Investor shall only pay in the amount of 30% of actual profits as an ultimate result of the year. Furthermore, if the second quarter results in a loss of $2,000, but the third quarter results in a profit of $6,000, then the 30% fee after the third quarter would only be assessed on $4,000 in overall profits as the losses in the second quarter would be subtracted from any monies that would otherwise be applicable to the fees.

Again, not all entities manage their fee structures this way. Some entities may only assess their, ‘Performance Fees,’ after a particular sporting season has concluded. Other entities may assess, ‘Performance Fees,’ on a Quarterly basis without it being stipulated that they are based on a, ‘High Watermark,’ which means that they might always charge fees on profitable quarters with losing quarters resulting in no offsets whatsoever. Again, I would personally be inclined to avoid any Entities that charge their Performance Fees in a manner that does not have any sort of offset in the event of future or previous losses. In these cases, an Investor could theoretically make money overall, but in actuality, end up losing money after paying the Performance Fees on the winning quarters and not having those fees offset in any way by losing quarters. Even worse, an Investor could actually lose money overall and STILL end up paying fees on the winning quarters. I certainly would not want to be paying someone a fee to lose my money for me...I could lose my own money Sports Betting just fine by myself, thank you.

If there are any other fees besides the ones that I have mentioned, I have not delved deeply enough into this concept of Entity Wagering to uncover them. However, as with anything else, make sure that you thoroughly peruse the Terms & Conditions of whatever Wagering Entity that you are considering Investing into and make sure that you have a comprehensive and complete understanding of whatever fee structures they have in place, as well as how those fee structures (on a percentage basis) impact your likelihood of enjoying overall profits.

Speaking of profits…

Withdrawing Your Money:

When it comes to these Wagering Entities, another aspect in which many of them differ is in how an individual can withdraw the money from their Entity of choice after depositing it. NSIG is one entity in which an investor can withdraw their money, with a minimum of $10,000 (unless the balance falls under $10,000, in which case, they could withdraw all of it) at anytime with no penalty whatsoever. For investors who would prefer to have a high degree of liquidity, (read: easy means to turn monies into cash in pocket) then an entity that allows withdrawals to be made at any time without fees would be a good choice for an individual who prioritizes this sort of thing.

Other entities have what is termed a, ‘Lock Out,’ period that Investors must wait for in order to withdraw money. For example, Contrarian operates under a Kelly Criterion based concept known as, ‘Full Kelly,’ in which the amount of money that is bet is strictly proportional, both percentagewise and in pure dollars and cents, to the amount of money that is available in the fund. As a result of this, Contrarian only has two dates of the year upon which they will allow withdrawals because a huge part of their Kelly Criterion based Wagering Strategy (Kelly Criterion can rightfully be called a, ‘Strategy,’ not a, ‘System,’ if someone is Wagering at an advantage, in fact, Kelly Criterion is used in more than just what would be traditionally called, ‘Gambling.’) is predicated upon the bankroll remaining consistent based on its starting point.

In other words, imagine that a fund started at $100,000 but one investor was responsible for $30,000 of that money. If there is a bet of $5,500 made that results in a loss and the big Investor panics (maybe he didn’t like the side that was taken) and wishes to withdraw that $30,000, then that is going to put a serious damper on the bankroll. The loss would put the overall fund at $94,500, of which $28,350 would still belong to the big investor. However, if the investor takes that money out, then only $66,150 would remain in the fund. The problem with that is that if the fund only had $70,000 to begin with, then the Full Kelly bet would not have been $5,500, it would have been $3,850...which may not seem like a huge difference, but when it comes to an Investment strategy, and assuming that the Entity would continue to use Full Kelly (assuming they have a positive expectation to begin with) it would take an unusually long time to make up for those losses for the other investors.

In other words, Contrarian would have essentially, ‘Overbet their bankroll,’ with respect to Full Kelly on the result of that one outcome, and as a result, effectively did not play Full Kelly but bet in excess of it. That is obviously not in line with the investment strategy of Contrarian, and as such, Contrarian essentially wants to make sure that the bankroll they are starting with, at a minimum, will be the one their decisions are based on throughout the entire betting season.

For those of you that read the interviews, though, Chris from Contrarian is not one to talk out of both sides of his mouth. You will see in the interview that he also specifically discourages Investors he already has from Investing MORE in the middle of a season because he does not want anyone to make any hasty decisions, to withdraw money OR invest more, based on short-term results. He is confident and has stated that he has a publicly documented record of, ‘Never having had a losing Sports season in Football or Basketball.” (That is speaking of College and Professional Sports Seasons combined, he has previously lost in either one or the other, but the winnings on the winning sports rank more than overcame the losses.)

With respect to withdrawing money, other Wagering Entities may have other terms that are either more stringent, more relaxed or otherwise fall somewhere between these two extremes. Once again, depending on what is important to every individual prospective Investor out there, I would be inclined to do some shopping around in order to determine what is the best fit.

The next question one might ask is, ‘Where are these bets made?’ The answer to that is, pursuant to the State of Nevada, any Sportsbook operating in the State can become approved to accept Entity Wagers, however, CG Technologies is currently the only approved Sportsbook at this time who has actually shown an eagerness to accept such bets. In the next section, we will take a look at the position of the Sportsbooks to the best that I can attempt to understand it:

Why Would the Sportsbooks Do This?

Of all of the questions that I have asked myself (and others) since I began my investigation of this new concept of Entity Wagering, the one that has still not been answered (largely due to my own failings, I’m sure) to my satisfaction is, ‘Why the Hell would the Sportsbooks do this?’

The first thing that needs to be understood is, as of the time of this writing, CG Technologies is the only Sportsbook operating in Nevada that accepts Entity Wagering. Many of those who would seem to be opposed, conceptually, to Entity Wagering highlight this as one of the primary strikes against it. They ask: With access to only one set of Lines, how can the Wagering Entities possibly beat the Sportsbook?

In my opinion, the answer to that is pretty simple. I would first maintain (as have those I have interviewed) that the Wagering Entities would absolutely LOVE to have full access to all of the Lines at the Nevada Sportsbooks because they would then be able to shop around for Lines that they find advantageous given that one Sportsbook might be offering a Line on a given contest that differs from that offered at another Sportsbook. For those of you who follow the NFL to any reasonable degree, you will know that the difference between a Line of +/- 3 and a LIne of +/- 3.5 is staggering, in the right situation, given the likelihood that the margin of victory (or defeat) for the winning (or losing) team is three points. If the Wagering Entities had access to all of the Lines, then that would give them the ability to exploit Lines that they see as weak, make more positive expectation bets, and therefore (at least, theoretically) increase their volume of bets and profits made in pure dollars and cents terms.

With all of that said, however, I do not think that there is anybody out there who would reasonably attempt to context that any individual Sportsbook has NEVER released a beatable Line that smart bettor could get on the right side of, much less CG Technologies specifically. In that sense, while the Wagering Entity may have access to fewer potentially beatable Lines, it can certainly be postulated that they still retain access to some.

Of course, that is where I get confused. I do not understand why CG Technologies or any other Sportsbook would want to accept wagers from these Wagering Entities. First of all, if we look at entities such as Contrarian and NSIG, just looking at the results on their websites, we see that, as of the time of this writing, those two entities are beating the Sportsbooks. And by, ‘Beating the books,’ I specifically mean, ‘Beating CG Technologies,’ because that is the only Sportsbook they are permitted to bet.

As I have discussed in other writings, the goal of the Sportsbook is not necessarily to outwit the players, it is to create a, ‘Balanced Line,’ or to adjust their Line such that it becomes as, ‘Balanced,’ as possible. When it comes to Point Spread bets, for instance, many Bettors must Lay $110 in order to win $100, so there is nothing a Sportsbook would love more than to open with a line of +/- 2.5 and to generate an equal (in dollars) amount of action on each side of that given Wager. The winning side is paid $100 and the losing side loses $110, so as a result, the Sportsbook ultimately makes $5 on every $100 Wagered in that scenario.

In that sense, the Wagering Entities are not necessarily always, ‘Beating the books,’ sometimes the betting comes in so lopsided on a given side of a Line that the Sportsbooks feel compelled to adjust the Line in a fashion that actually creates an Advantage for smart Bettors, which, of course, the heads of the Wagering Entities purport themselves to be. The way this happens is that a ton of public (read: square) money will come in on one side of a LIne, often the favorite, which will cause the Sportsbook to give the other side, often the underdog, even more Points on the Point Spread to deliberately make it a more attractive bet. The Sports Book wants some money to come in on the other side because they are, ‘Overexposed,’ on that side of the bet. Again, it is not the goal of the Sportsbooks, strictly speaking, to, ‘Beat, the players, if they could just sit back and get balanced action on every single Line they ever put out and just collect a no muss no fuss straight vig on all action...they would love nothing more!

In this sense, the Wagering Entities (and other smart Bettors) are essentially beating Bettors of lesser skill sometimes because it is those without skill who caused the Line to move the way it did in the first place thereby generating the advantage for the sharps in the first place. What is interesting about that is that the Sportsbooks might occasionally WANT the action from the sharps because it helps balance their books.

There are occasions, however, where the, ‘Opening Line,’ is itself beatable and by generating an amount of action against that Opening Line on one of the sides that the Sportsbook effectively cannot generate on the other side (without risking the possibility of, ‘Middling,’ themselves’) would result in the sharps beating the books in the straightest up way possible. It is these instances that result in my curiosity with respect to why the Sports Books would ever deliberately welcome action that, on its face, seems smart.

With all of that said, though, between the Interviews that I have conducted and my own thought that I have put into this matter, (whatever my thoughts may or may not be worth) I have come up with a couple of potential reasons that individually, or combined, might be why CG Technology is willing to accept the Entity Wagers:

1.) They are not necessarily keen on the current Entities, but the prospect of future entities excites them.

In order to operate as a Wagering Entity, there are a number of requirements that an individual or group must go through to get their business license to operate. Out of all of these requirements, however, ‘Winning,’ is not one of them. The State of Nevada has put provisions in place to ensure that Entity Wagering activities (in terms of bets and results) must be made available to Investors (as well as the State) in the form of reports, but the State of Nevada has no concern whatsoever for which particular entities or Investors actually win or lose.

With this in mind, perhaps the Sports Books believe that there will be a sufficient number of unsuccessful Entities that ultimately end up being opened up and that the action of those entities, presumably at a negative expectation, will be more than enough to offset the winnings of the, ‘Sharp,’ entities. In other words, some entities might theoretically be set up for nothing more than the purpose of essentially, ‘Free rolling,’ on their Investors (more on that later) and such entities might not necessarily be strictly concerned with whether they win or lose (though winning would increase both their cut and longevity) but might be satisfied with any initial fees that they collect from the Investors and seek to profit regardless of whether or not they win.

In other words, the heads of such entities could essentially be playing with the money of their Investors, and not necessarily at an Advantage. In other words, they could be gambling with the money of other people with only a miniscule amount of risk if any fees collected are not equal to their costs of operating, which is somewhat unlikely, because it does not seem as though there would be a ton of overhead associated with operating an entity.

Closely related, but not strictly so, some, ‘Square,’ bettors may watch exactly what the entities do and believe that they have learned the methodology behind it. In all likelihood, they probably haven’t and could not successfully identify the methodology that goes into an individual bet, much less, the process of making positive expectation bets on the whole, but the confidence that they have might give them cause to believe that they do not need to invest in these Entities and can win just fine on their own and keep 100% of the profits.

If this ends up being the case, as with the vast majority of overall sports bettors, they will end up being lifetime losers.

2.) Operation in other states.

In the interviews, one notion that has been thrown around is that Nevada is going to permit their Sportsbooks to operate in any states that legalize sports betting in the future. To that end, there is much speculation in the Sports Betting community that many states will be legalizing Sports Betting in the near future. Furthermore, in an indirect sense, these Sportsbooks will have already operated within those States if any of the investors are housed in those states, and furthermore, there is also the potential that Wagering Entities may be able to form in other States that eventually are expected to legalize Sports Betting.

3.) BECAUSE some Wagering Entities are Sharp!

Okay, stay with me on this one, have faith, I don’t think I’ve lost my marbles.

If some of the Wagering Entities have a long-term degree of success and they are able to take advantage of weak lines using their proprietary software and computer programs, then the Sportsbooks might actually be able to use the information provided by the fact that the Wagering Entities are betting to their advantage.

Imagine that early lines come out on a given NFL contest and, almost immediately, a Wagering Entity with a long track record of success immediately jumps on one side of the Line or the other. What that might tell the Sportsbooks is that the Line is weak and, as a result, the Sportsbooks might be able to make an early adjustment before even more heavy betting comes in and they really get hurt on a weak line.

Keep in mind that the Wagering Entities are not going to be the only sharps out there getting bets down, and in fact, other sharps, acting individually, might prefer to try to beat Lines on their own (or have people run bets for them) because they get 100% of the profits when that happens. In those situations, Wagering Entities coming in hard and fast on a particular side might serve as an indication to the Sportsbooks that they need to adjust their LIne to favor the other side a little bit more.

Could the Books Decide not to Accept the Bets of a Particular Entity?

One concern that Investors may have is that the Sportsbooks might eventually perceive one or more Entities as, ‘Too good,’ and will eventually refuse to accept any action at all from them. In that event, the Investor would either have to pull all monies out of this form of Investing, or alternatively, switch to what they perceive, for one reason or another, as a weaker Entity.

While this is theoretically possible, Chris from Contrarian Investments stated that he waited a few weeks after this whole thing started to begin placing any Wagers because he wanted to speak to people from CG Technologies in order to receive assurances that, not only would they not reduce their limits or back Contrarian off completely, but further, that they would continue to be willing to accept his personal action. According to what Chris said, what he got amounts to nothing more than a verbal promise that they would not take any adverse action against the Entities, including reducing their Wagering Limits, but that was sufficient for him to go forward with this whole thing.

I would assume that CG Technologies made similar assurances to the other entities, and to that effect, they said that the Wagering Limits imposed on these Entities would only be increased, but would never be decreased. That is important because when it comes to the model of these Wagering Entities, and such Limits could result in a theoretical, ‘Cap,’ that they could have in total investment fund dollars while still being able to bet in an Optimal manner.

For example, when you look at Contrarian Investments and their strategy of risking 5.5% on a particular side, in the event that their total investment fund ends up being such that their individual betting restriction ends up being less than 5.5% of the funds available, then they could no longer invest in the manner that they want to. Additionally, the fact that lesser percentages of the overall fund could be invested would also result in lesser growth of the fund and Return on Investment in terms of pure dollars and cents.

However, for the time being, there does not seem to be anything strictly codified to the extent that CG Technologies (or any future books) are required to continue to accept the action of a given Wagering Entity, or to otherwise strictly refrain from reducing their Limits. However, it would seem that the individual Entities have received assurances of other kinds that this will not happen.

Are the Wagering Entities Essentially Free-Rolling?

In answering this question, we first have to look at what I mean when I use the term, ‘Free-Rolling,’ and that term can refer to any sort of betting as opposed to just Sports Betting. For instance, I might tell you that I am tops at guessing Roulette Numbers, and if you provide me with $1,000 and let me bet the way I want to, I will only take 10% of any profits that are made. Of course, if I lose, then you simply lose money and I am not out anything.

I could see where, to a certain extent, the entities could be regarded as free-rolling and that is just another reason why I would only want to focus on entities that either take no fees from me upfront, or alternatively, a very VERY small percentage of my total investment as fees. The last thing that I would want is for a substantial percentage of my deposit to immediately go to fees and then the Wagering Entity gets to free roll on the rest.

Furthermore, that is also why I think it is important to research entities that are very transparent in posting their results, at all times, to investors and non-investors alike. If these entities are essentially going to get a free roll on my money, then I certainly want to ensure they have a proven track record of success. It is also for this reason that I would want to thoroughly understand how the, ‘Performance Fees,’ work and under what condition they are applied.

Generally, ‘Free rolling,’ is considered a negative term when it comes to the person or group that gets to do the, ‘Free rolling.’ Of course, if you are an Advantage Player and presented the opportunity for a Free Roll, then that is totally awesome.

If I am to be completely objective, then I really have no alternative but to answer this question, ‘Yes, they are essentially free-rolling.’ I simply see no other way of putting it.

Consider this: Even if investors only pay, ‘Performance Fees,’ and do not pay fees of any other kind, it is rather possible for losing Wagering Entities to make money. That is not true just because of the fee structure, but let us once again consider an entity that settles up their fees quarterly: If a Wagering Entity handles their Performance Fees quarterly, but they start out having a losing quarter for a month and a half such that the fund is down $10,000; imagine that investors then come in at that time with an additional $30,000, but at the end of the quarter, the Wagering Entity finishes down only $1,000.

What actually ended up happening in that scenario is that the Wagering Entity finished slightly down, but not ALL investors finished down. The investors that came in after the first month and a half of that quarter actually finished up, as is evidenced by the fact that the Entity was up compared to its low point, and the investors that came in at that point do pay the Performance Fees as a result of the fact that they profited.

The Entities Want, ‘Competition,’...Why?

For the time being, you won’t even hear most of the heads of the entities even describe the others as, ‘Competition,’ and many of them are outright eager for other Wagering Entities to spring up in an effort to essentially compete with them. On the surface, this might seem a bit unusual to most people who might think that the entity heads would prefer to have a monopoly on this new industry, or as close to a monopoly as possible, but that’s not true.

For the Wagering Entities that are truly confident that they will be able to demonstrate long-term success, the existence of lesser entities enables them to have other entities to compare themselves to that are not as successful, and as a result, these successful entities will be able to command greater percentage fees, greater minimum deposits, and perhaps, more fees upfront. Again, they have suggested that they want there to be more entities, not that they want all of the entities to win.

Secondly, if the entities (as a whole) are not performing particularly well, then that would be profitable for the Sportsbooks as a whole, and as a result, would leave them increasingly welcoming to all current as well as future entities. Furthermore, if other entities are performing poorly, then the Sportsbooks may be inclined to increase the Wagering Limits for all of the entities given that, as a whole, the entities are actually losing. This would prove only to be beneficial to winning entities who could then enjoy the ability to get more money down on the sides that they like.

Speaking of which, how could we figure out what sides they like?

How do the Wagering Entities Determine What to Bet?

The majority of the websites pertaining to Wagering Entities all state that they base their wagers either on computer simulations or on computer algorithms and programs that are proprietary and designed in order to find weaknesses in the betting Lines. The first thing that people might consider is that this statement sounds like a big Crock-Pot full of crap, but that’s not necessarily the case for a couple of different reasons:

First of all, it has been well-documented in multiple books and publications that such programs and computer simulations DO exist, so the question is not necessarily one of whether or not this is theoretically possible, but really rather an individual Entity’s computer is better at finding beatable situations that the computers used by the Sportsbooks (at least, in part) are at generating beatable Lines to begin with. However, as described before, that is not strictly necessary because the Sportsbooks are really big on risk management, so if they take heavy action on one side of a Line that was essentially a strong Line, then they might be forced to adjust that Line in a fashion that the computer used by the Entities, and yes, perhaps individual bettors, find advantageous. Again, sometimes it’s not about being smarter than the books, it’s about being smarter than the other players.

Secondly, it’s not like the Entities could really be more specific about their methodology than that. Theoretically, they could release the source codes of their programs and simulations to their Investors so that their Investors could peruse them to determine their efficacy, but if they did that, what would stop the Investors from simply copying all of the code and now having their own way of identifying and exploiting weak Lines...one that comes without a fee.

Furthermore, there are some Entities, such as Ken Murphy’s NSIG that do not bet, ‘With their gut,’ exclusively, but subjective considerations can become a factor in the event that they disagree with what the computers propose. For those of you who choose to read my interviews, you will see that he says he will sometimes NOT take a side even though the computer tells him to because he is subjectively against that side, but he will never CHOOSE a side based on subjective considerations. In simpler terms, his subjective opinion of a particular side simply makes him more conservative rather than less.

It is for these reasons that the Wagering Entities really cannot be much more specific about their methodology than they are on the websites, upon which they limit themselves to really general terms. One might argue that charlatans could make these same claims and, upon doing so, could also hide behind the same caveats as to why they cannot offer any more specifics on their particular methodology...and one would be right. Once again, it is for that reason that I would personally ABSOLUTELY only ever even remotely consider investing with Wagering Entities that make their selections transparent on their websites for Investors and Non-Investors alike ahead of the results. NSIG and Contrarian are two entities that have not only shown strong early results, but also, post their selections on their respective websites in this manner.

Who is Doing the Investing?

There are a number of people that are doing the investing from serious investors to people who simply believe they can win a little money entrusting the actual betting to one of these Entities, but still enjoy having a stake in the action on a particular game. If there is one thing that is absolutely true, it is that a game is almost always more interesting to watch if you have a few bucks on it. The Pittsburgh Steelers, who I absolutely do not like, are the team that I rooted for harder than I have ever rooted for any individual team on any individual occasion because they were crucial to a low-risk, high-return Playoff Bracket Pool I once entered into!

There are a number of serious investors, both in attitude and in capital, that are invested in this Entity Wagering in the earlygoing. For example, Ken Murphy from NSIG stated that, not only is the minimum deposit required to invest in his entity $25,000, but also, the majority of his investors have investment capital in the six and seven figures. This type of investment is very new and largely speculative, however, there are quite a few people interested in it who are inclined to further diversify their portfolios. Another thing to keep in mind is for most serious investors who are considering Equity Wagering, this comprises a very small percentage of their investment capitals, let alone net wealth, so this might be something to stay away from if you do not have a significant capacity for investment, and especially, if it is money you may need with the entities that have strict withdrawal procedures and timeframes during which withdrawal is allowed.

Aside from that, people who would otherwise be straight up Sports Bettors are doing the investing because they perceive that the heads of this Equity Wagering groups can actually win for them. They essentially know that they would lose their money if left to their own devices with respect Sports Betting, anyway, so they would just as soon leave it in the hands of these Equity Wagering firms.

What is the Future of Equity Wagering?

One thing that the heads of NSIG and Contrarian will tell you is that they would rather not talk about what they are going to do, because anyone can talk about what they are going to do, they much rather prefer talking about what they have done. It is true that Equity Wagering does not have a long history as the first legal Equity Wager took place on March 31st of this year, so as of this time, there is nothing even approaching a long history that they can point to as being in any way an indicator of future results.

However, they are in the early stages of attempting to generate a consistent success and return on investment that can be pointed to in the future and solor you to invest your money with them. In that sense, this could be where they are going.

The best possible scenario for Equity Wagering is that it becomes just as common (at least, in some circles) as Stocks, Bonds, Mutual Funds, Binary Options or any other regulated form of Investment, which this essentially is. In order for that to happen, it is not necessarily a requirement that all of the Equity Wagering firms win, certainly some of them will lose and some will go out of business as a result of their failures. Some might argue that it remains to be seen if ANY of them can return positive value in the form of long-term positive Returns-on-Investment, and that is a fair point.

However, what is really going to be required is that all of these Entities do what they say they are going to do with respect to things that are strictly within their control. For one, if they say that they bet conservatively, then they shouldn’t be taking four or five sides every day...that couldn’t consistently happen at an advantage over a prolonged period of time, especially not with access to only one book. They have to honor their end of the agreement with respect to their own policies on deposits and withdrawal requests. There also has to be no misappropriation of client funds by any of these Entities as that could cast aspersions on the entire young industry. The Entities must make sure that they only pull out profits that they have earned in fees, and furthermore, if they do have a, ‘True up,’ policy, they have to make sure they have sufficient funds set aside to honor that.

Any failures in any of those regards could cast aspersions on the entire industry, and while funds have certainly been mismanaged on occasions in other types of investment scenarios, those types of investments have a much longer overall history and, as of now, more providers of the services such that the wrongdoings of only a few have little to no possibility of collapsing an entire industry.

Conclusion:

Entity Wagering and Investment into such firms is in its infancy, but it is available to anyone that can pass the mustard when it comes to verification of the funds that they are using to invest.

Whether or not I would personally invest in such firms is very much a loaded question, and it must be taken on an individual-by-individual basis. The sort of questions that you have to be able to answer is, most importantly, whether or not a given Entity has demonstrably proven that they can win over the long-term, at least to your satisfaction. In the event that the answer to that is, ‘Yes,’ then the next thing that you have to look at is whether or not you think a given firm can win to enough of an extent that it is not only profitable for you after the, ‘Performance Fees,’ but also, that it is profitable enough to such a strong extent that it is expected to beat anything else you could be doing with your money in terms of Return on Investment.

The next thing you have to determine is whether you think the fee structure is fair and whether or not it is within your financial means to make the minimum (or more) deposit, whatever that deposit may be for a given Entity. Furthermore, you would also want to look into what the withdrawal allowances are to ensure that you are not investing money that you would need to be able to liquidate at any given time. If that were the highest of your priorities, then you would certainly need to invest with an entity that allows for withdrawals to be made at any time without a penalty.

In addition to that, you’re going to have to do an honest appraisal of yourself and determine whether or not you are comfortable having someone making decisions with your money on your behalf. Are you going to be overly concerned if your Wagering Entity loses three consecutive picks as soon as you invest even when, provided they do have an advantage on their action, could be nothing more than simple Variance? If so, then Equity Wagering is not for you.

Furthermore, you also have to be willing to accept that not all of your money will be in action at any particular time, in fact, only a very small percentage of it usually will. Many people might look at this as their money, ‘Doing nothing,’ but a major reason for this is because of the long-term approach these entities take to Wagering combined with the Proportional nature of the way losses and wins are divvied up, in general.

Whether or not this is right for you is not something I could answer, the only thing that I could do is look at someone’s overall situation and determine whether or not it is worth it for an individual person to take the risk. Obviously, with so little data available to me, (though I acknowledge that at least two entities are trending extremely well) I usually would not be inclined to offer a person any individual advice one way or another.

However, if you have any money that you could invest whatsoever, nor would I dismiss this form of investment out of hand. I would take a good hard look at how the terms of the entities that are extremely upfront with their results apply and what they mean to me, and then I would determine whether or not I believe that they could do a better job with my money than either I could, or alternatively, a better job making me profits than a more traditional form of investor could. One thing is for sure, I am definitely paying attention to what they do now, will definitely continue to do so, and will follow up accordingly.